Inheritance tax planning for high-net-worth individuals is an incredibly complex business. The extensive assets of a high value estate – combining cash, businesses, stocks and shares, property portfolios, and precious personal items like jewellery and art – can quickly add up to an enormous inheritance tax bill.

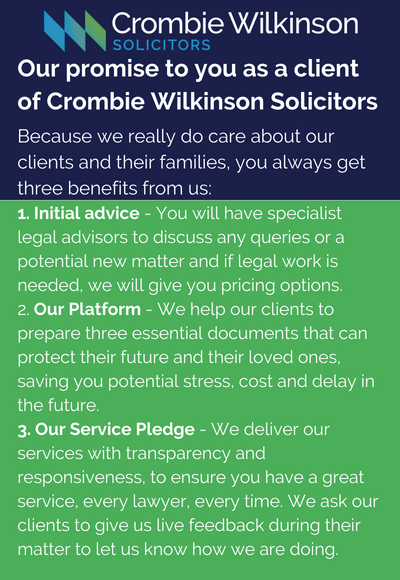

At Crombie Wilkinson Solicitors, our expert team is on hand to help with your Estate and Inheritance Tax Planning. We can discuss your options and arrange a wealth management solution that could reduce your inheritance tax bill, provides support for future asset growth, and ensures your beneficiaries receive the maximum amount possible from your generous endowments.

Inheritance Tax planning for a High Value Estate

When it comes to estate and inheritance tax planning for high-net-worth individuals, early preparation and careful attention to detail are the key to ensuring your heirs inherit the maximum value from your estate.

Along with the vast array of assets, the added tax complications of ever-expanding wealth, family businesses, international property, and potentially tricky family dynamics can all cause additional distress at an already difficult time.

For instance, if you get divorced, you may want to rewrite your Will to reflect that change. Of if you remarry and want to ensure your children from a previous relationship are provided for after your death, that will require advance planning and specific wording in your Will.

Our experienced wealth management solicitors can assist in writing your Will and planning your estate to make the most of inheritance tax rules, strategies and relief schemes – protecting your wealth and preserving it for future generations. We also work closely with independent financial advisors when it is needed to provide you with the information and advice you need for your personal circumstances.

Inheritance tax on million-plus estates

For people who have estates and assets of more than £1 million pounds, estate planning can be difficult. But it also become much more vital as - even with all the tax-free allowances available - once you hit the £1 million, you will have to pay inheritance tax in one form or another.

There are 3 main situations to consider when working out IHT for estates worth more than £1million:

- Situation 1: If you’re single and haven’t used your ‘residence nil rate band’, you pay 40% of anything over the £325,000 threshold.

- Situation 2: If you have use the RNRB, you pay 40% on anything over £500,000.

- Situation 3: If you’ve have inherited the above threshold from your spouse, you only start to pay 40% on anything over £1million.

So, you have an estate worth £2million, you would pay 40% on either £1.675m as per situation 1, on £1.5m if you fall into situation 2, or on £1m if you fall into the third group.

For estates valued at more than £2,000,000, the RNRB (and any transferred RNRB) will be gradually withdrawn or tapered away even if a home is left to direct descendants. The RNRB will be reduced by £1 for every £2 that the value of the estate is more then the £2,000,000 taper threshold.

However, it’s worth noting that the 40% rate can be reduced if you give 10% of your estate’s value to charity. It reduces the tax from 40% to 36%.

You can also reduce the tax by giving away gifts more than 7 years before your death. If you give your gift less than 7 years before your death, you will pay up to 32% on the value (this value reduces the close to get to the 7-year threshold).

Using trusts to reduce Inheritance Tax

A trust is a legal arrangement where an asset is placed under the control of a trustee or group of trustees. Once it is in the control of the trustees, the asset no longer technically belongs to you – so it won’t be counted as part of your estate when you die. Used smartly, trusts can greatly reduce your estate’s inheritance tax bill.

Contact us for High Net Worth Inheritance Tax Issues

If you’re considering establishing a trust for your beneficiaries, talk to Crombie Wilkinson Solicitors. Our experienced wealth management solicitors will talk you through the options for your high-value estate, including trusts, inheritance tax gifts, and other ways to reduce your inheritance tax bill.